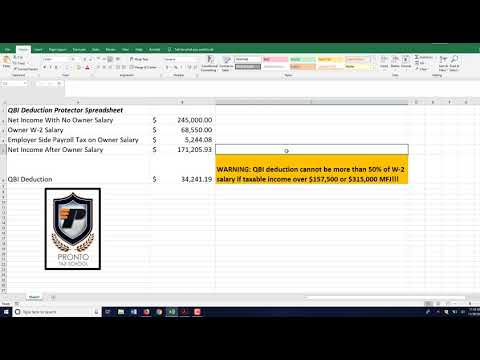

Alright guys, I wanted to take this quick video for you. So, one thing that's going to be quite tricky, especially since it's new this year, is this qualified business income deduction for people that are on a pass-through entity. Specifically, in the case of West Corporation, when the income exceeds the limits of $157,500 for any filing status other than married filing jointly, or $315,000 for married filing jointly, the QBI deduction will be limited based on the owner's W-2 salary. If you want more details on all of this, you can get into one of our courses and delve deeper into the topic. This spreadsheet I'm showing you is fairly simplified, but I want to demonstrate what's going on because there are some client matters at the end of the year where the owner may be deciding what salary to take. Many S corporation clients are choosing to have a lower salary, which can actually decrease their QBI deduction. As you can see, the net income from the business with no salary is shown here, and this column represents the salary. Your goal is to optimize the salary so that the QBI deduction is 20% of the net income. However, it cannot be more than 50% of the W-2 number. You want to ensure that the salary is optimized in order to make sure they receive the entire deduction. If anything in this cell exceeds 50% of the W-2, they will lose that deduction. We just don't want you guys to be blamed for that. So, if your clients reach out to you about how much they should be paying in salary, that's great. But you also want to segment your client database to find people who may be affected by this. Again, you don't want them to miss out...

Award-winning PDF software

4835 qbi Form: What You Should Know

The deduction is not available if the rent or royalty payment must be paid to a foreign entity. The farm rent or royalty payment is also not qualified business income. When the Section 164 deduction is claimed, the income must be from farming, fishing, farming furniture, livestock, or livestock products. The section 164 income must be qualified business income. The deduction and deduction limitations are separate. As you can see, the IRS has made clear that income related to farming should be income from agricultural farming activities. As you can see, income from farming is not qualified business income and can't also be deducted from a taxable business income. However, you may be able to deduct some part of the expenses or expenses of farming on Schedule C (Form 1040). This deduction is available only if the activity is actually engaged in for profit and not an expense. If the income exceeds the income from agricultural farming activities, the Section 168 expense deduction is not used and can be taken from the total of the income from agricultural farming activities and the income from the other source.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4835, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4835 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4835 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4835 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 4835 qbi